Impartner: The #1

Partner Relationship

Management Software

Manage every type of partner in one place

to drive more revenue with less work.

The #1 Partner Relationship Management Software

Manage every type of partner in one place to drive more revenue with less work.

Turn your ecosystem into a revenue-generating powerhouse

Turn your ecosystem into a revenue-generating powerhouse

Today’s partner ecosystem leaders must be able to drive trackable, ROI-validated revenue at scale. From the largest global enterprises to emerging startups, Impartner PRM helps companies of all sizes accelerate revenue for every type of partner.

From resellers to referral partners, ISVs to MSPs, effortlessly move your GTM strategies forward with the best partner management software: Impartner.

Automate your indirect sales processes with partner lead management

New indirect sales opportunities need to get in the hands of your most highly-qualified partners, fast. With Impartner, assign new leads to the right partner at the right time based on criteria built into your PRM.

It’s time to empower your partners like they’re an extension of your sales team. Automate key processes around lead timelines, deal registration, and multi-partner lead collaboration. Get immediate updates from your partners, so you always have real-time data on lead timing and trends to share with your team. Our industry-leading integrations mean you can also sync your data directly with your CRM of choice.

Curate every step of the partner journey to enable greater revenue

As an ecosystem leader, you need to guide each partner through the onboarding experiences, training, and performance behaviors that you know will drive growth.

Whether you’re managing affiliates and influencers, resellers or distributors, or service partners like MSPs or implementation specialists, build hyper-personalized journeys for each partner segment with Impartner. Drive greater revenue with individualized partner business plans. Inspire more performance with partner tiers and rewards. And, with data on every partner and every journey they take, you’ll finally get the clarity you need to sustainably grow your ecosystem.

Seamlessly integrate your partner data across your tech stack

Our integrations take business-as-usual to an entirely new level. Harness powerful integrations with your existing tech stack to see all your partnerships data in one place.

Each integration supports real-time and bi-directional data flows, and mapping to any standard or custom objects or fields. Find native integrations for leading CRMs like Salesforce or HubSpot, account mapping tools, LMS tools, and more.

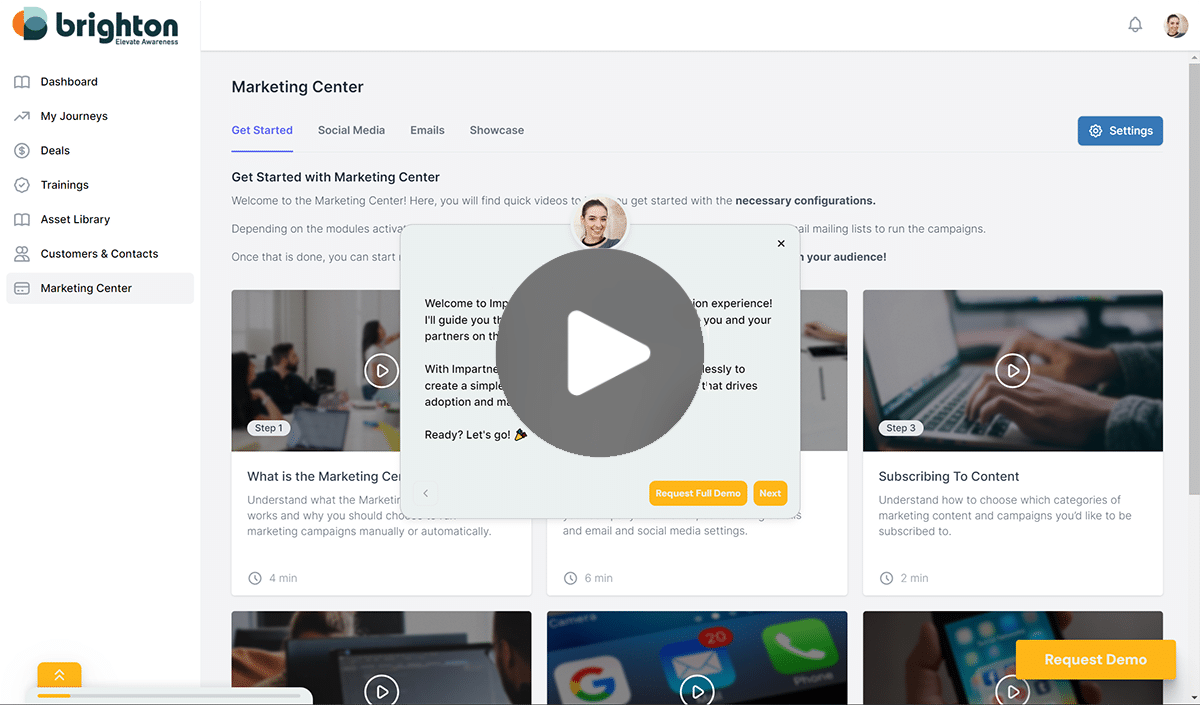

Ignite demand with partner marketing automation tools

Market to, through, and with your partners to drive incredible demand. Our partner marketing tools make it easier, more automated, and more scalable for you to do the work for your partners.

From hyper-targeted email campaigns to your global partners to microsites built to showcase your products on partner websites, you can take on much of the heavy lifting so your partners can focus on selling and servicing your products. Build paid media campaigns directly on their behalf to find local customers and put MDF dollars to work.

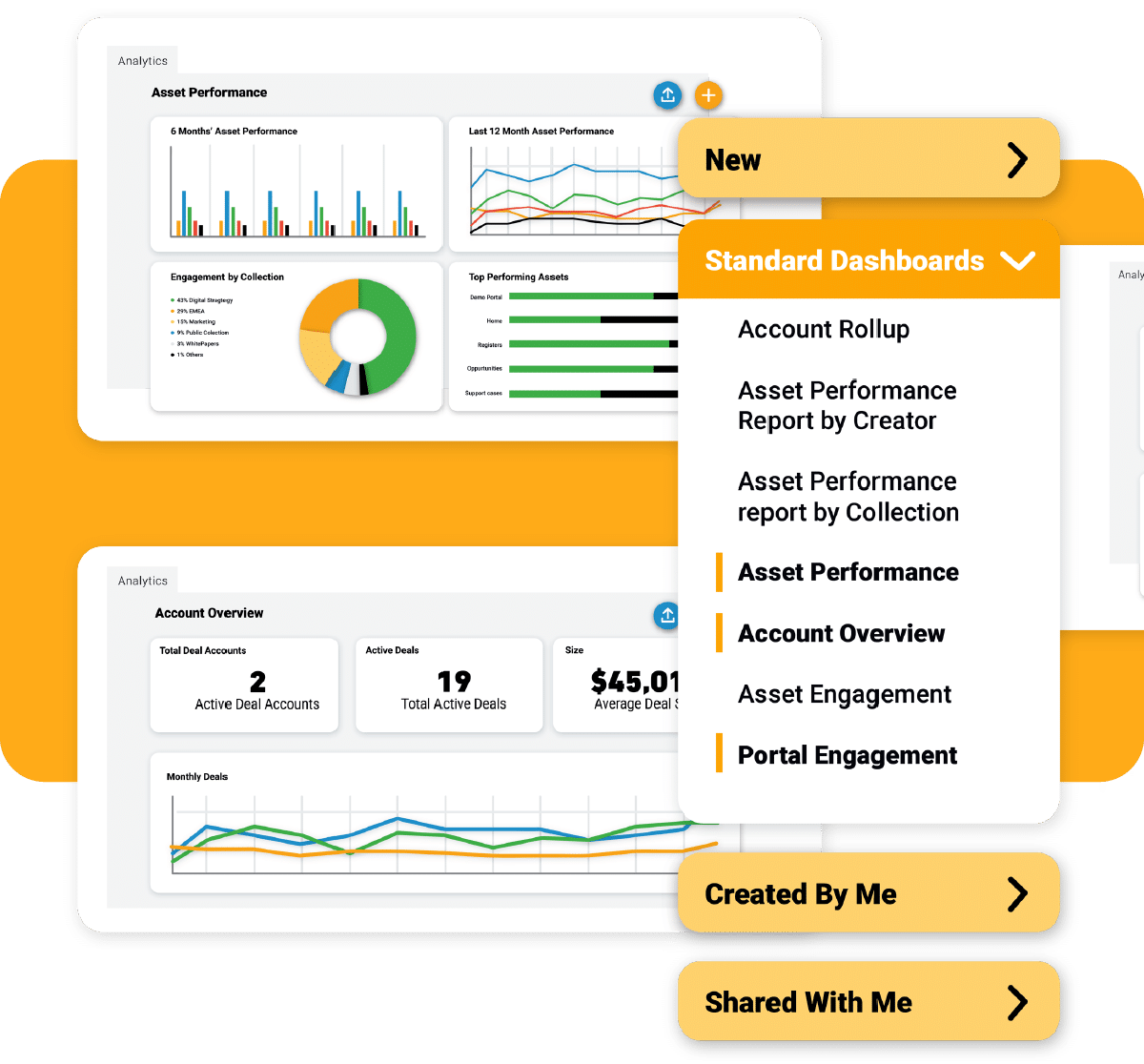

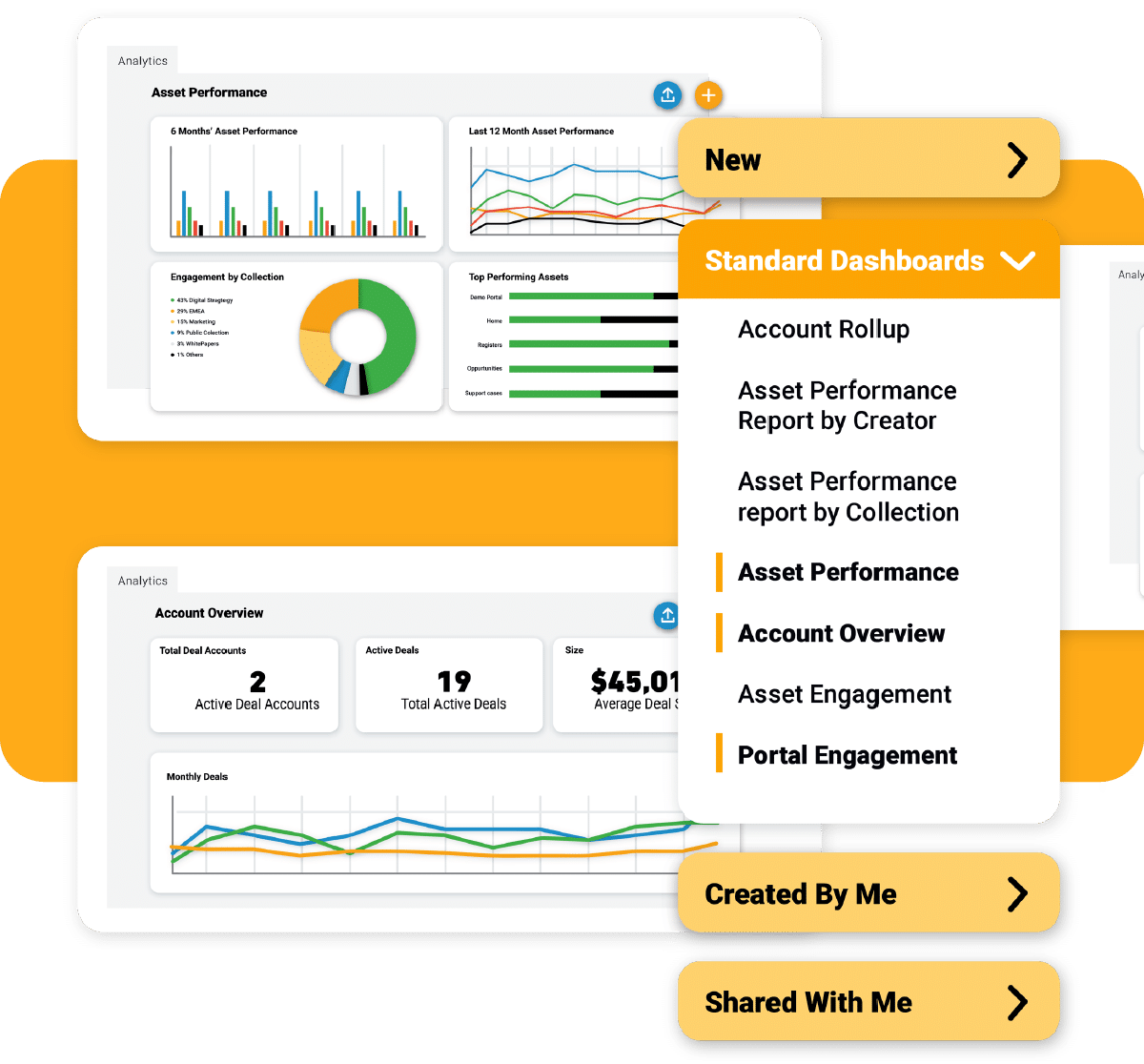

Track and share the analytics that matter most for growth

Whether managing ten or tens of thousands of partners, you need to pinpoint exactly which partners, actions, and strategies are driving revenue and profitability in your ecosystem.

Create a 360-degree view of every partner, no coding required. Build personalized dashboards and visuals with easy drag-and-drop functionality. Share dashboards with your internal teams and your partners for greater transparency. Finally, you’ll be able to consolidate your partner analytics data into one place and integrate it seamlessly with your CRM, LMS, ERP, and other business-critical software.

Unlock significant growth with Impartner

A commissioned study conducted by Forrester Consulting found that a composite organization based on Impartner customers achieved the following:

296%

return on investment over 3 years

Up to 50%

increase in partner-sourced deals

$2.4M

net value over 3 years

Impartner redefines modern administration and refines intuitive partner experiences… Impartner makes it easy to manage a modern partner experience. The platform has advanced capabilities presented in an intuitive interface…

Impartner redefines modern administration and refines intuitive partner experiences… Impartner makes it easy to manage a modern partner experience. The platform has advanced capabilities presented in an intuitive interface…

—Hannibal Scipio

Impartner named a Leader in The Forrester Wave™:

Partner Relationship Management, Q3 2023

Manage everything partner-related in one place

To stand out in a crowded vendor marketplace, you must create a partner-first ecosystem that prioritizes engagement and enablement for your partners. With Impartner PRM, you can build powerful partnerships and automate the rest.

Maximize growth with partner business planning tools

Create, track, and share goals to drive greater revenue and performance with each of your partners. You and your partners get full visibility into channel data so you can work towards your goals, together.

Collaborate with each of your partners on their personalized business plan with partner-editable progress updates, notes, and attachment uploads. Easily create, track, and change any KPI, from any CRM object (even custom objects!), with a simple drag and drop interface, no coding required. And, with Impartner, learn what’s working (and not working), so you can create better data-driven strategies in the future.

Learn how you can grow faster, together with business planning tools

Build automated tiering programs to inspire greater performance

Do you know which partners are driving the most revenue, and what they’re doing to achieve it? If not, you could be overpaying partners or leaving top performing partners underutilized.

Fundamentally transform your partner experience by easily managing and communicating your ecosystem’s program compliance metrics to partners and stakeholders right within your portal. Build code-free partner tier programs where both you and your partners can track progress towards greater tiers and related benefits.

Transform your co-selling motions with on-demand asset management

Extend your marketing reach to the channel and beyond with co-branded marketing collateral within a centralized asset library built into your partner portal. Partners can access your data sheets, guides, brochures, web banners, and more whenever and wherever they need.

Then, enable partners to add their logo and other branding elements to these assets in minutes – all while keeping the integrity of your brand intact.

Get to market faster with personalized training and certification programs

It’s simple: The better trained your partners are on your products and services, the better they can sell, service, and support them. With Impartner, you can easily build code-free courses, lessons, quizzes, and certification programs for your partners.

Segment your different onboarding, training, and certification tracks so you get the right depth of training to the right partners.

Build partner and solutions marketplaces on your corporate site

When your potential customers are ready to purchase, or if they want more in-depth product information, they want to interact with a partner who is in their area, understands their vertical, has the right certifications, and can lead them through the purchasing process.

With Impartner’s marketplace tools, you can connect your prospective customers to qualified partners and their solutions in record time. It’s not just a search tool–it’s a lead generation marketplace for you and your partners.

Ecosystem leaders at the world’s top companies agree: Impartner is the best partner management platform

Impartner is rated #1 by customers on G2

We’re rated #1 overall on G2 for enterprise partner relationship management, over Salesforce, Zift, PartnerStack, Mindmatrix, Allbound, and more.

Reduced cost per lead

by 75%

Google Ads has become our first source of leads for our partners across all geographies. With Impartner, we have been able to reduce the cost per lead by 75% and we have seen a huge acceleration in lead generation without increasing media budgets.

Google Ads has become our first source of leads for our partners across all geographies. With Impartner, we have been able to reduce the cost per lead by 75% and we have seen a huge acceleration in lead generation without increasing media budgets.

—Isabelle Pampelune

SMB Business Development Lead, Xerox

Achieved 300% YoY

ecosystem growth

Impartner significantly reduced the time it took us to evaluate and process deal registrations from partners, saving hours and hours of time.

Impartner significantly reduced the time it took us to evaluate and process deal registrations from partners, saving hours and hours of time.

What was previously a manual process became automated, leading to better insights and one reporting view between teams.

—Dao Tran

Global Alliances Director, SoSafe

Doubled channel revenue

in 2 years

When we first started, we were at 20% channel revenue. After two years, we're at 50%. Now, we're looking to recruit another 700 additional partners, but we're not going to hire another 50 account managers. We're relying on Impartner to be that catch-all for our partners.

When we first started, we were at 20% channel revenue. After two years, we're at 50%. Now, we're looking to recruit another 700 additional partners, but we're not going to hire another 50 account managers. We're relying on Impartner to be that catch-all for our partners.

—Sam Valme

Senior Director of Channel Experience, AvePoint

From chaos to clarity

It’s more about the journey...

Give your partners the best experience possible with the suite of products offered by Impartner.

Recruit

Drive traffic of potential new partners to the partner registration process via email campaigns and public-facing web pages. Leverage the configuration abilities of Impartner to create messaging to entice the right type of partners to apply for access.

Enroll

Easy application process for potential partners that leads to a sophisticated approval workflow system so that you can carefully select who gets to pass through the velvet rope and be welcomed into your exclusive content and toolset provided to your authorized partners.

Onboard

Getting your partners onboarded and provided with portal credentials is only the beginning. You need to truly guide each partner through their journey that will drive them to their first dollar of revenue generated for you. Doing so in an automated, scalable fashion will provide a consistent and repeatable experience.

Train & Enable

Curate and present professional training material to the right partners at the right time that facilitates testing to confirm competency. The better trained a partner is on your products, the better they can sell and support those products, and the happier your customers will be.

Manage Pipeline

Make it easy for your partners to register deals and have the data sync in real-time to your CRM to resolve channel conflict. Also, have a well-defined delivery process of pre-qualified leads to your high performing partners to carry until close.

Sell

Provide all the sales and marketing materials within Asset Library that are needed to assist partners to be successful, including enabling co-branding or white labeling of any documents of your choosing. It’s important to make these materials easy to find with in-document search and simple to preview, download, or share with one-click options.

Generate Demand

Amplify your marketing messages by extending lead generation campaigns to your partners’ networks with our low-touch methodology, which maximizes your reach by simplifying and automating adoption. No matter the source, you will have full lead attribution for a complete ROI picture and reliable delivery methods to get hot leads into partners’ hands immediately.

Through Channel Marketing Automation (TCMA)

Market Development Funds (MDF)

Impartner Marketplace

Engage & Communicate

Successful channels know the importance of remaining in regular communication with your partners. The best channels provide 100% personalized and targeted content in a highly scalable and cost-effective manner to deliver far better audience engagement. When executed properly, you up-level your partners to be experts of your brand.

Motivate & Reward

Partners are mostly coin-operated, so it’s imperative that you provide a clear and simple picture of the rewards they stand to gain for being successful with you. The levels of access, benefits and progress of rewards need to be spelled out plainly to your partners to keep them motivated.

Plan & Optimize

It’s said that without goals, and plans to reach them, you are like a ship that has set sail with no destination. This is especially true for your partners. Create business plans where partners and their channel managers can both track progress toward stated goals in real time and avoid an unpleasant QBR surprise.

Measure

Analyze what’s working and what’s not across every aspect of your indirect sales with the same insight you have into direct sales. All key aspects of your Impartner platform are collected into pre-packaged reports – sales pipeline, asset engagement, journey or training progress – or create your own personalized reports and dashboards to get the exact data that you need to identify successful partners or areas for possible improvement.

Recruit

Drive traffic of potential new partners to the partner registration process via email campaigns and public-facing web pages. Leverage the configuration abilities of Impartner to create messaging to entice the right type of partners to apply for access.

Enroll

Easy application process for potential partners that leads to a sophisticated approval workflow system so that you can carefully select who gets to pass through the velvet rope and be welcomed into your exclusive content and toolset provided to your authorized partners.

Onboard

Getting your partners onboarded and provided with portal credentials is only the beginning. You need to truly guide each partner through their journey that will drive them to their first dollar of revenue generated for you. Doing so in an automated, scalable fashion will provide a consistent and repeatable experience.

Train & Enable

Curate and present professional training material to the right partners at the right time that facilitates testing to confirm competency. The better trained a partner is on your products, the better they can sell and support those products, and the happier your customers will be.

Pipeline

Manage Pipeline

Make it easy for your partners to register deals and have the data sync in real-time to your CRM to resolve channel conflict. Also, have a well-defined delivery process of pre-qualified leads to your high performing partners to carry until close.

Sell

Provide all the sales and marketing materials within Asset Library that are needed to assist partners to be successful, including enabling co-branding or white labeling of any documents of your choosing. It’s important to make these materials easy to find with in-document search and simple to preview, download, or share with one-click options.

Demand

Generate Demand

Amplify your marketing messages by extending lead generation campaigns to your partners’ networks with our low-touch methodology, which maximizes your reach by simplifying and automating adoption. No matter the source, you will have full lead attribution for a complete ROI picture and reliable delivery methods to get hot leads into partners’ hands immediately.

Through Channel Marketing Automation (TCMA)

Market Development Funds (MDF)

Impartner Marketplace

Communicate

Engage & Communicate

Successful channels know the importance of remaining in regular communication with your partners. The best channels provide 100% personalized and targeted content in a highly scalable and cost-effective manner to deliver far better audience engagement. When executed properly, you up-level your partners to be experts of your brand.

Reward

Motivate & Reward

Partners are mostly coin-operated, so it’s imperative that you provide a clear and simple picture of the rewards they stand to gain for being successful with you. The levels of access, benefits and progress of rewards need to be spelled out plainly to your partners to keep them motivated.

Plan & Optimize

It’s said that without goals, and plans to reach them, you are like a ship that has set sail with no destination. This is especially true for your partners. Create business plans where partners and their channel managers can both track progress toward stated goals in real time and avoid an unpleasant QBR surprise.

Measure

Analyze what’s working and what’s not across every aspect of your indirect sales with the same insight you have into direct sales. All key aspects of your Impartner platform are collected into pre-packaged reports – sales pipeline, asset engagement, journey or training progress – or create your own personalized reports and dashboards to get the exact data that you need to identify successful partners or areas for possible improvement.

Take an interactive tour

Power your ecosystem with our end-to-end partner relationship management tools. You’ll be able to configure the platform effortlessly to create a seamless experience for your partners that drives greater revenue and engagement.

Explore the partner management platform experience for admins in our full product tour.

PRMs are foundational to world-class partner organizations. When implemented, integrated and managed correctly, PRMs act as a hub for partner-related data, content and relationships, enhancing visibility, productivity and efficiency. PRM has transformed from a nice to have that manages singular partner strategies, to a necessity for supporting a robust ecosystem and scaling successful channel strategies.

PRMs are foundational to world-class partner organizations. When implemented, integrated and managed correctly, PRMs act as a hub for partner-related data, content and relationships, enhancing visibility, productivity and efficiency. PRM has transformed from a nice to have that manages singular partner strategies, to a necessity for supporting a robust ecosystem and scaling successful channel strategies.

—Jay McBain

Chief Analyst

Defining the world of partner relationship management

Over a decade ago, Impartner was the first to coin the term “PRM.” Today, over 40,000 users leverage Impartner to manage millions of partners with their ecosystems. We draw on our long-standing expertise in the channel to create content and learning experiences that help partnership leaders like you thrive.

Impartner PRM pricing: Built to scale

Optimize your partner relationship management at every stage of ecosystem growth.

What real customers say about

our partner management platform

Frequently asked questions about partner relationship management

What is partner relationship management?

Partner relationship management is about building trust, transparency, and mutually beneficial relationships, which are crucial in a business environment where partners can significantly contribute to your revenue and growth. With the best PRM software, you can enhance partner satisfaction, engagement, and collaboration within your larger channel ecosystem.

What does PRM software do?

This software streamlines communication, offering features like partner onboarding, training, deal registration, and marketing resources. Partners benefit from easy access to essential information, enabling them to focus on sales. PRM software also provides insights into partner activities and analytics, aiding support and identifying growth opportunities within the channel ecosystem.

What’s the best partner management software?

The best partner management software can streamline your tasks, enhance your partner experiences, and accelerate ecosystem growth. The largest and most highly rated partner management software is Impartner, which is used by millions of active partners every day.

To make the right choice, you must figure out your needs. Start by studying user reviews and analyst reports, defining your goals and required features, prioritizing automation-first platforms, and seeking seamless integrations with your existing tech stack. Look into their existing support resources and pricing models and test drive with a demo. It’s all about finding the ideal solution to transform your partner management approach.

What is the difference between CRM and PRM?

What integrations does Impartner support?

Impartner offers a wide range of native integrations to streamline your partner management processes. Easily connect and sync your partner data with popular CRM systems like Salesforce, HubSpot, and Microsoft Dynamics, ensuring seamless collaboration between your partner and customer data. It also supports integration with marketing automation platforms, ERPs, LMS tools, account mapping software, and more. Plus, its flexible API options allow you to connect with various tools and applications, ensuring that your partner management platform fits seamlessly into your existing tech stack.